Rental Properties vs. Fix-and-Flip: Which Real Estate Investment Is Better?

December 09, 2024

Thinking about diving into real estate investing?

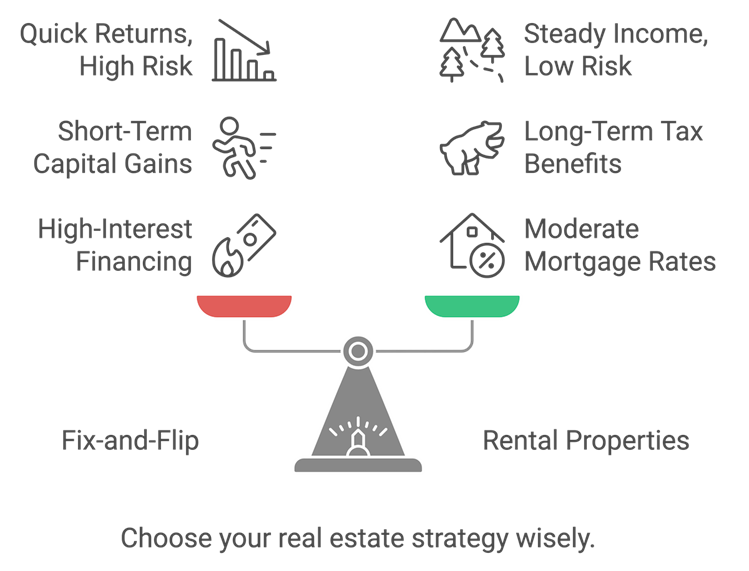

Here's the million-dollar question: should you aim for steady rental income, or go all-in on flipping properties for quick profits?

Both paths have their perks and pitfalls. It's all about what fits your goals, your appetite for risk, and how much time you've got to hustle.

Let's cut through the noise and get to the facts.

Fix-and-Flip: Speed and High Stakes

Flipping properties is like sprinting in the real estate game. You buy a fixer-upper, pour cash into renovations, and sell it fast for a higher price.

But it's not for the faint-hearted. Quick profits come with steep risks.

The Numbers Behind the Flip

In Q2 2024, 79,540 homes were flipped, making up 7.5% of all U.S. home sales.The average gross profit per flip? $73,492, delivering a 30.4% return on investment (ROI).

But here's the catch: flipping isn't as profitable as it used to be. ROI has dropped from 49.2% in 2016 to 27.5% in 2023.

That shrinking margin reflects rising competition and skyrocketing renovation costs.

Why Some Investors Love Flipping

Flipping works for people who:

- Want fast returns without waiting years for property values to climb.

- Love rolling up their sleeves and adding value to homes through design and renovation.

- Thrive on the adrenaline of fast-paced decision-making.

If that sounds like you, flipping might be your lane.

But it's not all sunshine. Hard money loans-a common tool for financing flips-often carry interest rates between 10%-15%, eating into profits.

For a closer look at loan options, check out Crowd Lending's loan tools.

Challenges to Watch

Flipping comes with big risks. Market dips, unexpected repair bills, or delayed sales can drain your profits fast.

High taxes are another downside. Flipping profits fall under short-term capital gains tax, which can reach up to 40%.

Rental Properties: The Steady Play

Owning rental properties is more of a marathon than a sprint. You lease your property to tenants, generating a steady income while the property appreciates over time.

It's slower, but the payoff builds year after year.

The Long-Term Wins

Rental properties deliver an average annual ROI of 10%. Add monthly rent checks to the mix, and you've got a stable income stream.

Taxes? Much kinder to landlords. Rental income is taxed at just 15%-20%, far less than the short-term tax rate for flipping.

And let's not forget equity. Every mortgage payment boosts your ownership stake in the property.

Looking for high-demand rental spots? Cities like Atlanta and Detroit are booming markets for long-term investments. Explore more about rental opportunities at Crowd Lending.

Comparing Costs

Here's a side-by-side look at the expenses tied to flipping vs. renting:

Expense | Fix-and-Flip | Rental Properties |

Financing | High-interest (10%-15%) | Moderate mortgage rates (5%-7%) |

Taxation | Short-term capital gains | Long-term rental income taxes |

Ongoing Costs | None after sale | Maintenance, repairs, and property management |

Time Commitment | Short-term, high-stakes | Long-term, consistent effort |

Choosing the Right Strategy

Here's the deal: what works for one investor might not work for you.

What's Your Financial Goal?

Want quick capital? Flipping's your game.

If long-term wealth and passive income sound better, rentals are the way to go.

How Much Risk Can You Handle?

Flipping comes with volatility. A bad flip could sink your profits, while a great one could double your investment.

Rentals offer stability but need patience. You won't see massive returns overnight, but the long game rewards persistence.

Tax Implications

Let's talk about the tax man.

Taxes often tilt the scale toward rentals. Flipping profits are hit with short-term capital gains tax, up to 40%.

Rental income? Just 15%-20%, with the bonus of deductions like mortgage interest, repairs, and even depreciation.

Here's how it looks on paper:

Tax Factor | Fix-and-Flip | Rental Properties |

Tax Rate | Up to 40% | 15%-20% |

Deductions | Limited to renovation costs | Depreciation, repairs, interest |

Depreciation | Not applicable | A major advantage |

Trends in Real Estate Investing

The real estate market never sits still. Here's what's hot right now:

Fix-and-Flip Trends

More investors are entering the flipping space, but shrinking margins mean you've got to be smarter than ever.

Financing is evolving too. Hard money loans and faster approval processes are giving flippers a leg up. Get insights on the best loans at Crowd Lending.

Rental Property Trends

Rental demand is booming, especially in suburbs and multifamily units. Build-to-rent developments are taking off as developers cash in on rising rents.

Making Your Move

Here's how to get started, no matter which path you choose.

For flips, prioritize these steps:

- Hunt for undervalued properties in growing markets like Phoenix or Detroit.

- Nail down your financing fast. Visit Crowd Lending for tools to streamline your funding.

- Renovate with ROI in mind. Focus on kitchens, bathrooms, and curb appeal.

For rentals, focus on this:

- Research neighborhoods with high demand.

- Run the numbers. Factor in cash flow, maintenance, and taxes.

- Screen tenants thoroughly to avoid headaches down the road.

Final Thoughts

Whether you're chasing quick flips or aiming for steady rental income, there's no one-size-fits-all answer.

Flipping can deliver fast rewards, but it's risky and tax-heavy. Rentals build wealth over time with stability and significant tax perks.

The key is knowing what you want-and making a plan to get there.

For more tools and insights, visit Crowd Lending.